Making Tax Digital for Income Tax (MTD fIT)

Change is coming for many taxpayers as HMRC rollout the next phases of Making Tax Digital for Income Tax (MTD fIT). This is our dedicated MTD fIT area which we will keep updated to support our clients, present and future, throughout the journey.

You will need to be prepared to change but we are committed to supporting you every step of the way to help you the find digital solution for you.

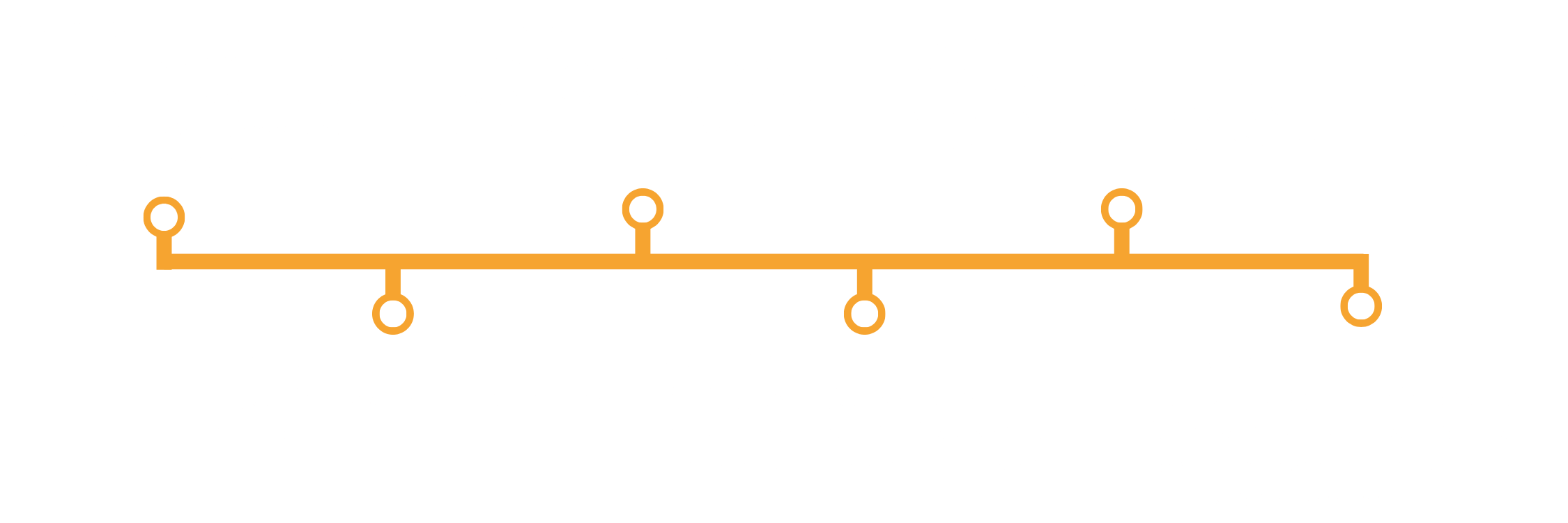

An overview of the current timeline is below to help you plan for when you and your business need to be ready:

Newsletter

Sign up to receive the latest news from Larking Gowen